Ethiopia’s total public external and domestic debt continues to rapidly increase, according to the latest Public Sector Debt Portfolio Report published by the Ministry of Finance on January 19, 2025. According to the report, the country’s debt reached $68.9bn in 2024, up from $63bn in 2023, and $54.9bn in 2020. This represents a 25.5% increase in debt over four years.

In 2024, out of Ethiopia’s total external debt of $28.9bn, multilateral agencies own 52% of the debt, bilateral creditors own 28%, while the remaining 20% is held by private creditors.

Furthermore, an overwhelming 45.8% of Ethiopia’s external debt is denominated in US Dollars (USD), which leaves the country’s economy and debt servicing capacity increasingly susceptible to fluctuations in exchange rates due to a strengthening US economy and USD.

Debt as a percentage of GDP stands at 32.9%, while debt as a percentage of exports is 179.8% — as the threshold for Ethiopia is 150%, this indicates a debt to exports ratio over the threshold. Similarly, debt service to export ratio, currently at 11.3% — exceeds the established threshold of 10% — representing another indicator that has been breached and elevating the country’s debt distress level to high risk.

The public debt dynamics over the last few years have worsened, according to the report, “due to the external sector’s poor performance indicating some risk on debt sustainability.” In other words, the poor performance of exports continues to hamper foreign exchange earnings and the ability to ensure debt servicing.

Consequences of Free-Floating the Exchange Rate

The report also highlights the increasing debt burden precipitated by Ethiopia’s free-floating of the exchange rate in July 2024.

According to the report, “the external debt portfolio is exposed to exchange rate risks owing to the adoption of a free-floating exchange rate. Hence, any significant depreciation of the Ethiopian Birr against foreign currencies can substantially contribute to higher debt service payments in local currency terms. As a result, there could be higher debt service payments in the budget than forecasted.” This assessment is already beginning to materialize.

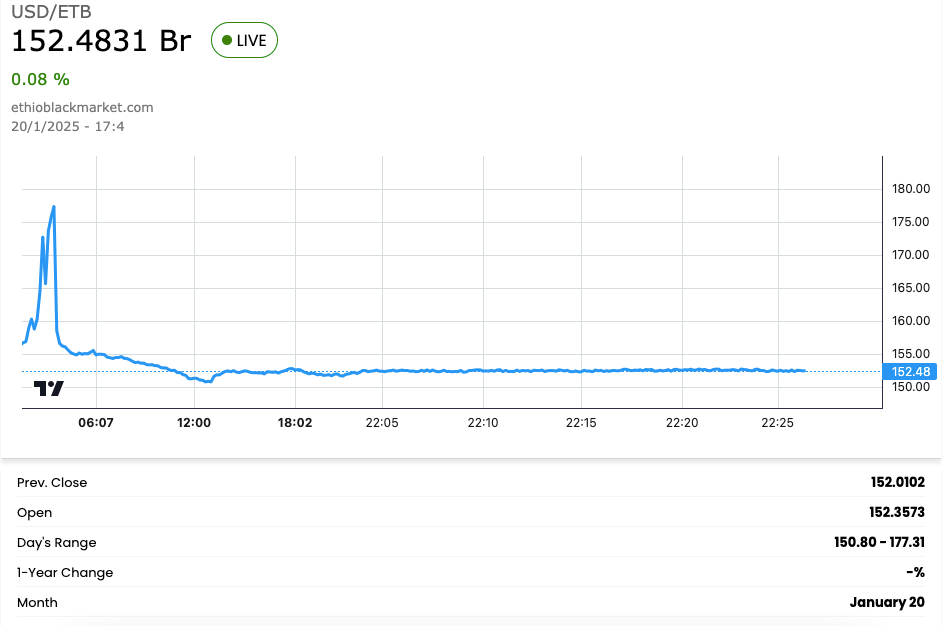

Since the policy change, the Birr has depreciated significantly — from 57 Birr/USD, to 117 Birr/USD, to now 152 Birr/USD — representing a 120%+ depreciation in just six months. As a consequence of the steep depreciation, Ethiopia’s nominal GDP has declined from $207bn to $100bn, while external debt increased from $28.9bn to $31bn, and the debt to GDP ratio increased from 32.9% to 50.3%.

Furthermore, “exchange rate unification” between the official and parallel markets — a stated objective of the Abiy Ahmed regime — continues to be allusive. For instance, in the parallel market, the exchange rate now ranges between 152-177 Birr/USD, while the official rate is 124 Birr/USD.

Ultimately, the effect of free-floating the exchange rate has been to squeeze the poor. The economic consequences of a weaker Birr, high inflation, increasing cost of living, increasing taxes, and less social programs due to austerity measures continue to be felt most by the least well-off in Ethiopian society — 85%+ of Ethiopia’s population, according to the United Nations Development Programme.

In other words, in the short and medium term, the policy change will continue to exacerbate poverty and inequality. This, in turn, risks creating greater levels of social discontent and civil unrest.