On Tuesday, July 15, 2025, in its latest country report, the International Monetary Fund (IMF) warned Ethiopia that its so-called “Home Grown Economic Reform Agenda” funded by a $3.4 billion bailout loan from the IMF is facing challenges from declining donor support and fragile security conditions.

Specifically, the IMF warned that rising risks, such as a resurgent parallel foreign exchange market, declining donor support, and fragile security conditions, could hinder progress and complicate debt restructuring efforts.

Ethiopia remains in default and is seeking comparable debt relief from bondholders after agreeing terms in principle with official creditors earlier this year. “The outlook remains subject to downside risks given security challenges and declining donor support,” said IMF Deputy Managing Director Nigel Clarke.

IMF Austerity Policies and Foreign Aid Cuts Undermine Development Outcomes

Due to IMF austerity policies, Ethiopia is experiencing declining education and health services and outcomes. Budget cuts to education and health sectors have resulted in decreased real incomes, resource shortages, and increased workloads for teachers and health workers. This jeopardizes service delivery and exacerbates poverty and inequality – and requires reform in policy and funding, according to the Ethiopian Policy Institute.

At the same time, foreign aid to Ethiopia has fallen from 12% of gross domestic product a decade ago to under 4%, with further cuts anticipated as agencies like USAID scale back. The IMF noted that one in five Ethiopians required food or humanitarian assistance this year, with the United Nations response plan underfunded and many programs relying on temporary waivers.

As part of an IMF structural adjustment program, signed in July 2024, Ethiopia has undergone a wholesale economic liberalization and privatization agenda, including foreign exchange market liberalization. Exactly one year after policy adoption, the Ethiopian currency, Birr, has depreciated by over 170%, while structural issues persist, including inflationary pressure, debt distress, 2.5% central bank commission on FX sales, limited interbank liquidity, and high transaction costs.

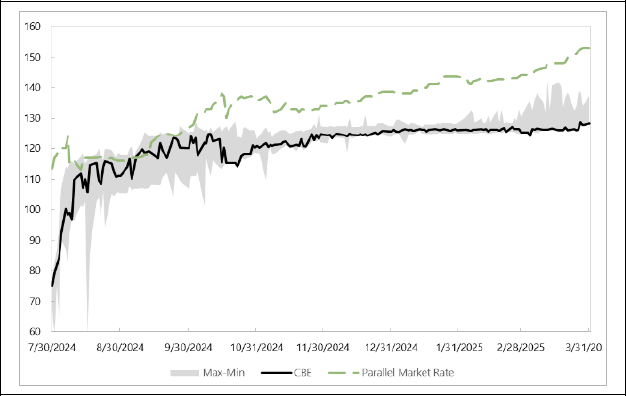

These factors have pushed the parallel market premium to 15%, with the increasing spread between the official and market exchange rate expected to persist (Figure 1). At the same time, deeper structural factors in Ethiopia — notably concerns about property rights, security, and conflict also play a role is encouraging outflows of wealth through the parallel market, the IMF said.

Figure 1: Range of Bank’s Daily Weighted Average Rate (Birr per US$)

Even amid Ethiopia’s economic mismanagement and free fall, the IMF is urging the Abiy Ahmed regime to “accelerate its transition to a modern policy-rate-based framework and improve communication to bolster credibility.” Additionally, the IMF raised concerns over “privatization delays and weaker-than-expected foreign direct investment”, which could complicate efforts to rebuild reserves and close the balance of payments gap — exposing the country to financial market volatility.