Ethiopia’s parallel foreign exchange market rate continues to skyrocket, with the exchange rate hitting a staggering 174 Ethiopian Birr (ETB) per USD — a sharp increase from the 150 ETB of just days ago, and a significant jump from the official market rate of 134 ETB.

The widening gap highlights the persistence of structural macroeconomic imbalances, and the deepening strain on the Abiy Ahmed regime’s economic liberalization and privatization agenda.

On July 29, 2024, the Abiy regime announced the free-floating of the currency, and the regime’s objective to “unify the official and parallel foreign exchange market rates.”

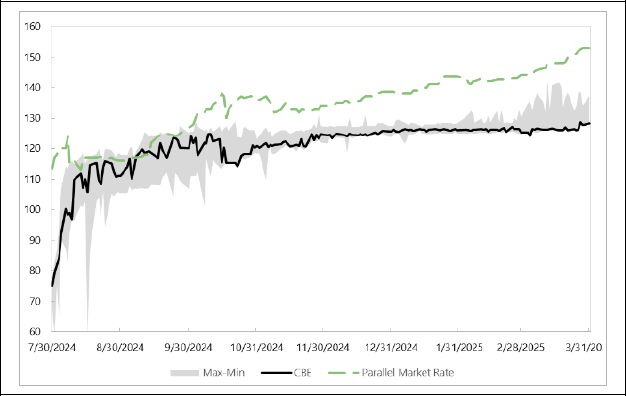

While the parallel market premium was initially reduced in the weeks after liberalization, it has begun to increase significantly once again (Figure 1).

Figure 1: Range of Bank’s Daily Weighted Average Rate (ETB/USD)

As Figure 1 illustrates, the premium between official and parallel market rates increased to 15% by April 2025, according to the IMF. However, recent market data suggests the premium has now doubled to 30%.

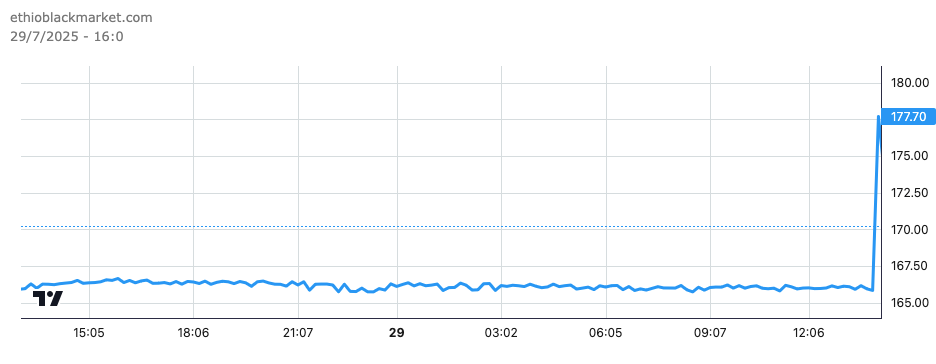

While official rates hover at 139 ETB per USD at Forex Bureaus and 134 ETB per USD at Commercial Bank of Ethiopia, the new parallel market rate ranges from 174-177 ETB per USD — reflecting a premium of 30% (Figure 2).

Such a persistently widening gap continues to undermine the Abiy regime’s credibility, while fueling public skepticism about the so-called “reform agenda”.

Figure 2: Parallel Market Rate, ETB/USD (July 29, 2025)

Structural Macroeconomic Imbalances Persist

As part of an IMF structural adjustment program, signed in July 2024, Ethiopia has undergone a wholesale economic liberalization and privatization agenda, including foreign exchange market liberalization. Exactly one year after policy adoption, the ETB has depreciated by over 170%, while structural issues persist, including inflationary pressure, debt distress, a 2.5% central bank commission on foreign exchange sales, limited interbank liquidity, and high transaction costs.

These factors have now pushed the parallel market premium to 30%, with the increasing spread between the official and market exchange rate expected to persist. At the same time, deeper structural factors in Ethiopia — notably concerns about property rights, security, and conflict are playing a significant role is encouraging outflows of wealth through the parallel market.