Ethiopia is the least-attractive jurisdiction in the world for mining investment, while Finland is the most attractive jurisdiction followed by Nevada and Alaska, according to the Annual Survey of Mining Companies released by the Fraser Institute, an independent, non-partisan Canadian policy think-tank.

The report ranks 82 jurisdictions around the world based on their geologic attractiveness — minerals and metals — and government policies that encourage or deter exploration and investment.

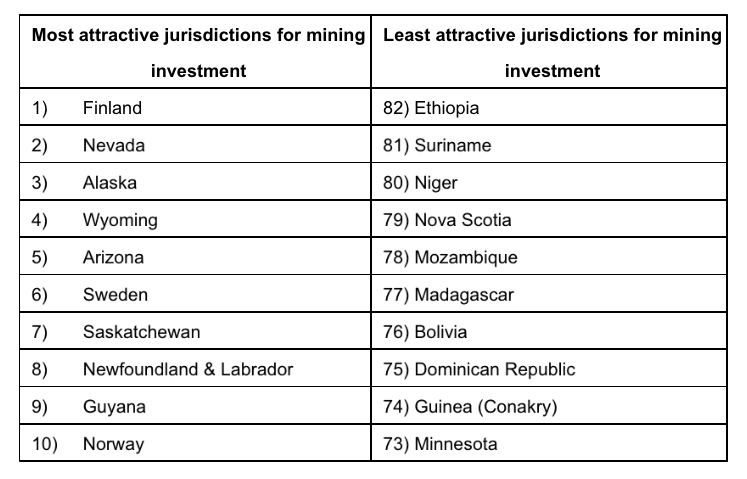

According to the report, when considering both policy and mineral potential in the Investment Attractiveness Index, Ethiopia ranks as the least attractive jurisdiction in the world for investment (Figure 1). Also in the bottom 10 are Suriname, Niger, Nova Scotia, Mozambique, Madagascar, Bolivia, Dominican Republic, Guinea (Conakry), and Minnesota.

Figure 1: Investment Attractiveness Index 2024

Mining, Economic Mismanagement, and Policy Misprioritization

In Ethiopia, the Abiy Ahmed regime has made the mining sector a central pillar of its economic policy, alongside tourism — a significant departure from the manufacturing and export-led growth strategy that had propelled the country to an average annual real GDP growth rate of 10.9% for over a decade.

As outlined in its “Homegrown Economic Reform Agenda” (2020), mining is one of the five priority areas of the Abiy regime, although mining is not a sector in which Ethiopia has a comparative advantage — accounting for a mere 1% of GDP and 0.5% of employment.

A capital intensive sector, mining contributes very little to job creation in developing countries — even in countries with large natural resource endowments. This is compounded by the fact that raw minerals are exported to developed economies for value-addition.

Notwithstanding these challenges, the Abiy regime has made mining a central pillar of its economic policy, at the expense of manufacturing and industrial policy, including Ethiopia’s once promising industrial parks policy (PDF).

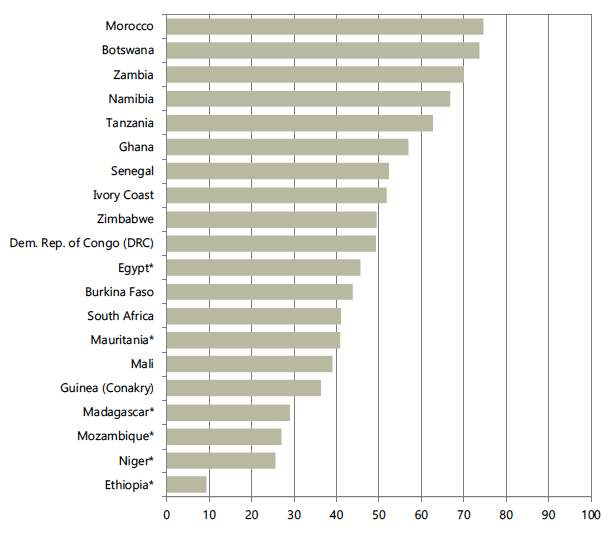

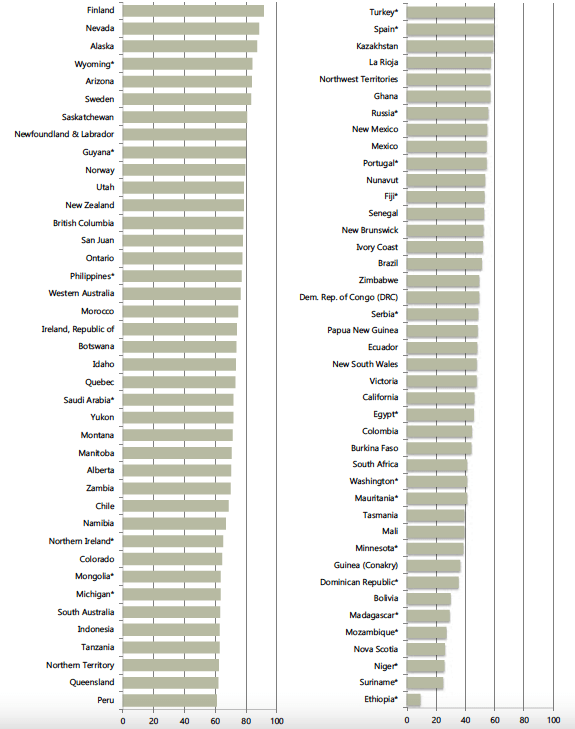

In this context and under the guidance of the Abiy regime, Ethiopia’s mining sector — replete with “colossal corruption and illicit financial flows” — not only underperforms, but has become a vehicle for mass corruption and the misappropriation of funds. As a result, Ethiopia’s mining sector ranks as the least attractive for investment not just in Africa (Figure 2), but globally, according to the latest global mining rankings and report (Figure 3).

Figure 2: Investment Attractive Index—Africa

Figure 3: Investment Attractive Index—Global

Across Africa, Morocco, Botswana, and Zambia are the top performers. In particular, Botswana remains a top performing African country, although the country slipped on the overall Investment Attractiveness Index, falling to 20th from 15th last year. On the policy front, Botswana placed 14th out of 82 globally. However, its policy perception score fell from the previous year – when it ranked 4th out of 86 – reflecting growing investor unease. Concerns around regulatory duplication and inconsistency rose sharply, along with apprehensions over security and the legal system.

The report highlights that mineral deposits alone are insufficient to attract investment. What is required is a well formulated strategy, a sound and predictable regulatory framework coupled with competitive fiscal policies to make a jurisdiction attractive to investors, note the authors.